IRA Interest Rates Bank of America: Navigating the world of retirement savings can be complex, but understanding the interest rates offered by major institutions like Bank of America is crucial for maximizing your returns. This comprehensive guide delves into the intricacies of Bank of America’s IRA interest rates, exploring various account types, influencing factors, and comparisons with competitors. We’ll unpack the details, helping you make informed decisions about your retirement planning.

The whispers around Bank of America’s IRA interest rates felt strangely…tingling. A sudden question arose: Before committing, one must consider the nature of mortgage lenders, specifically, is it prudent to understand whether is rocket mortgage a bank , given their influence on the broader financial landscape? The answer, it seems, holds a key to deciphering those unsettlingly high IRA rates at Bank of America.

From traditional and Roth IRAs to rollover options, we’ll dissect the fee structures, eligibility requirements, and investment choices available. We’ll also analyze how market conditions and account balances impact interest rates, providing historical examples and hypothetical scenarios to illustrate long-term growth potential. By comparing Bank of America’s offerings to those of its competitors, you’ll gain a clearer picture of the market landscape and choose the best strategy for your financial future.

Bank of America IRA Accounts: A Critical Analysis

Retirement planning is a crucial aspect of financial security, and Individual Retirement Accounts (IRAs) play a vital role in achieving this goal. Bank of America offers a range of IRA options, each with its own features, fees, and eligibility requirements. This analysis critically examines Bank of America’s IRA offerings, comparing them to competitors and providing a comprehensive overview for potential investors.

Bank of America IRA Account Types

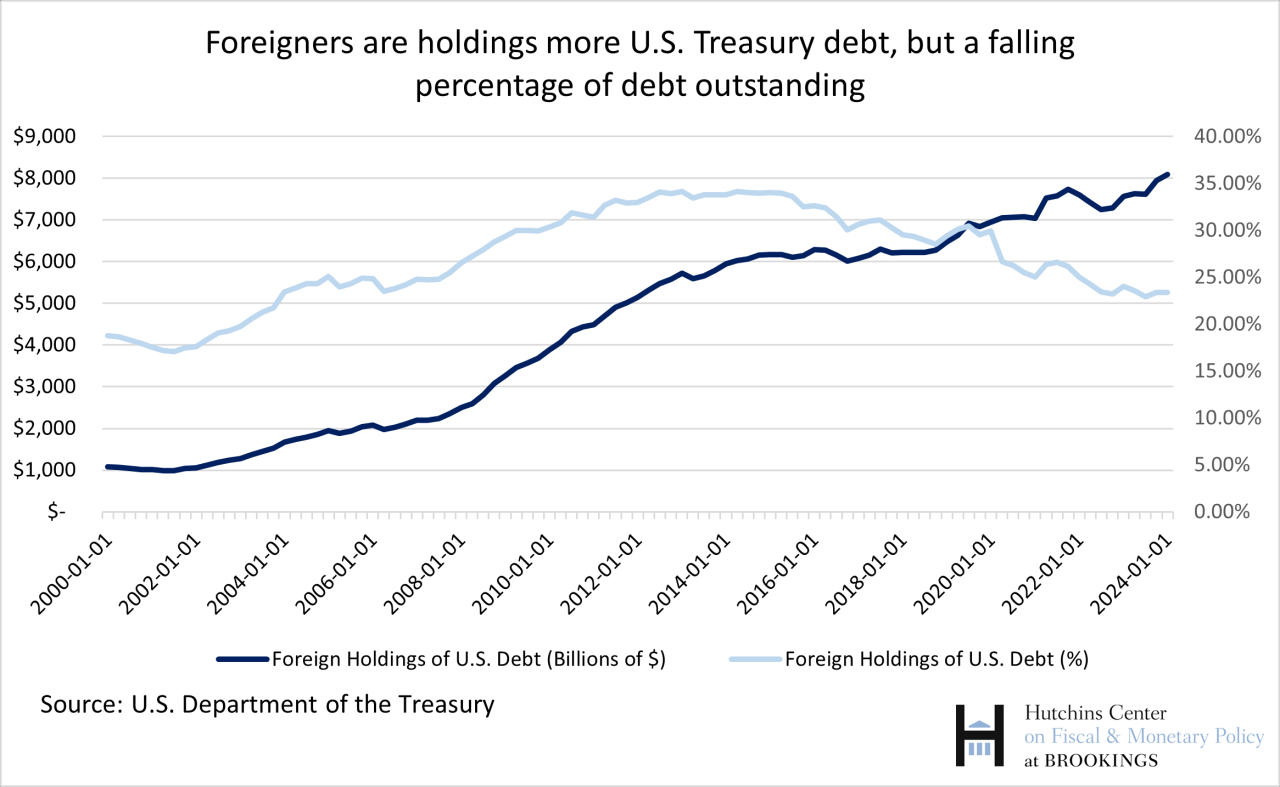

Source: brookings.edu

Bank of America provides three primary IRA account types: Traditional, Roth, and Rollover IRAs. Each caters to different financial situations and retirement goals. Understanding the nuances of each is crucial for selecting the most appropriate option.

- Traditional IRA: Contributions are tax-deductible, but withdrawals in retirement are taxed as ordinary income. This option is beneficial for those in lower tax brackets now, anticipating higher brackets in retirement.

- Roth IRA: Contributions are made after tax, but withdrawals in retirement are tax-free. This is advantageous for those in higher tax brackets now, expecting lower brackets in retirement.

- Rollover IRA: Allows the transfer of funds from a previous employer-sponsored retirement plan (like a 401(k)) into a Bank of America IRA. This offers greater investment flexibility and control.

| Account Type | Minimum Deposit | Annual Fee (Example) | Investment Options |

|---|---|---|---|

| Traditional IRA | $1,000 (Example – may vary) | $25 (Example – may vary depending on account balance and specific plan) | Mutual funds, ETFs, CDs, etc. |

| Roth IRA | $1,000 (Example – may vary) | $25 (Example – may vary depending on account balance and specific plan) | Mutual funds, ETFs, CDs, etc. |

| Rollover IRA | Varies (depending on the amount rolled over) | $25 (Example – may vary depending on account balance and specific plan) | Mutual funds, ETFs, CDs, etc. |

Note: Fee structures and minimum deposit requirements are subject to change and should be verified directly with Bank of America.

Interest Rate Information and Factors, Ira interest rates bank of america

Bank of America’s IRA interest rates are not fixed and fluctuate based on several key factors. Understanding these influences is vital for managing expectations and making informed investment decisions.

- Market Conditions: Prevailing interest rates in the broader financial market significantly impact the rates offered on Bank of America’s IRA accounts. Rising interest rates generally lead to higher yields, while falling rates result in lower returns.

- Account Balance: Higher account balances may sometimes qualify for preferential interest rates. This is a common practice employed by many financial institutions to incentivize larger investments.

Historically, Bank of America’s IRA interest rates have shown variability, mirroring the fluctuations in the overall market. For instance, during periods of economic expansion, rates have generally trended upward, while during recessions or periods of economic uncertainty, rates have typically declined. Specific historical data would require access to Bank of America’s past rate sheets.

Hypothetical Scenario: Assume a $10,000 initial investment in a Bank of America IRA. With a hypothetical average annual interest rate of 3% over 10 years, the account would grow to approximately $13,439 (assuming no additional contributions). However, with a 5% average annual interest rate, the same investment would grow to approximately $16,289. This illustrates the significant impact of even small variations in interest rates over a longer investment horizon.

Comparing Bank of America IRA Rates to Competitors

Comparing Bank of America’s IRA offerings with those of competitors is crucial for making informed choices. This comparison focuses on key aspects such as interest rates, fees, and account features. Note that this comparison uses hypothetical examples for illustrative purposes and actual rates may vary.

| Institution | Average Interest Rate (Hypothetical) | Annual Fee (Hypothetical) | Key Features |

|---|---|---|---|

| Bank of America | 2.5% (Hypothetical) | $25 (Hypothetical) | Wide range of investment options, extensive online tools |

| Fidelity | 2.75% (Hypothetical) | $0 (Hypothetical – may vary based on plan) | Strong online platform, extensive research resources |

| Schwab | 2.25% (Hypothetical) | $0 (Hypothetical – may vary based on plan) | Robust customer service, broad range of investment choices |

Note: Interest rates and fees are hypothetical and subject to change. Actual rates should be verified with each institution.

IRA Investment Options at Bank of America

Bank of America offers a diverse range of investment options within its IRA accounts, catering to various risk tolerances and investment strategies. Carefully considering the risk-reward profile of each option is essential.

- Mutual Funds: Professionally managed portfolios offering diversification across various asset classes. Risk levels vary depending on the fund’s investment strategy.

- Exchange-Traded Funds (ETFs): Similar to mutual funds but traded on stock exchanges, offering greater flexibility and potentially lower fees. Risk levels vary.

- Certificates of Deposit (CDs): Fixed-income investments offering a guaranteed return over a specified period. Generally considered low-risk.

Risk Levels and Return: Higher-risk investments, such as stocks or aggressive growth mutual funds, have the potential for higher returns but also carry a greater risk of loss. Lower-risk investments, like CDs or bonds, offer lower potential returns but greater capital preservation.

Understanding IRA Contribution Limits and Rules

Staying within the established contribution limits and understanding the tax implications are crucial aspects of IRA management. Failing to adhere to these rules can result in penalties.

- Annual Contribution Limits: The annual contribution limit for both Traditional and Roth IRAs is subject to change annually and should be verified with the IRS. There may also be limits on how much can be contributed based on income.

- Income Limitations for Roth IRAs: There are income limits for contributing to Roth IRAs. If your income exceeds a certain threshold, you may not be eligible to contribute or your contribution may be limited.

- Contribution Process: Contributions to a Bank of America IRA can typically be made online through their website or mobile app, or via mail.

- Tax Implications: Traditional IRA contributions are tax-deductible, while Roth IRA contributions are not. However, Roth IRA withdrawals in retirement are tax-free, while Traditional IRA withdrawals are taxed as ordinary income.

Bank of America IRA Customer Service and Resources

Bank of America offers various customer support channels and resources to assist IRA account holders. Accessing these resources can significantly enhance the IRA management experience.

- Customer Support Channels: Phone support, online chat, in-person assistance at branches, and email support are usually available.

- Online Resources: Bank of America typically provides online account access, transaction history, investment tracking, and educational materials.

- Educational Materials: Many financial institutions provide webinars, articles, and other educational resources to help customers understand their IRA accounts and make informed investment decisions.

- Advantages: Wide branch network, established reputation, diverse investment options, online tools.

- Disadvantages: Fees may apply, potential for higher fees compared to some online-only brokers.

Final Wrap-Up: Ira Interest Rates Bank Of America

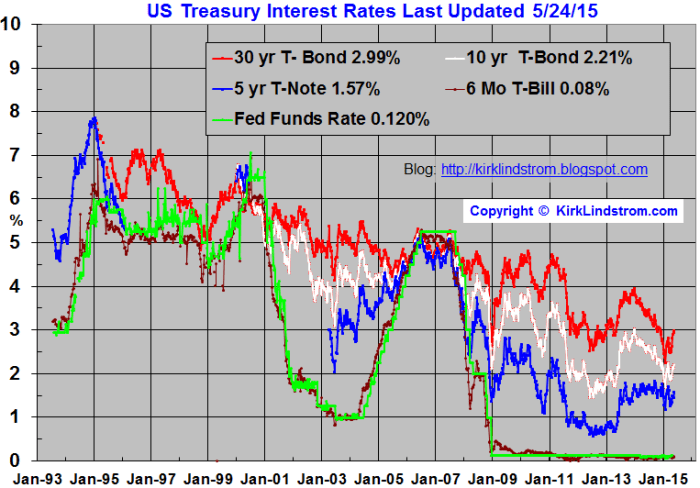

Source: kirklindstrom.com

Planning for a comfortable retirement requires careful consideration of various factors, and understanding IRA interest rates is paramount. This guide has provided a detailed look at Bank of America’s IRA offerings, highlighting the nuances of different account types, interest rate calculations, and investment options. By comparing Bank of America’s rates to those of its competitors and understanding the contribution limits and tax implications, you can make informed decisions to optimize your retirement savings strategy.

Remember to consult with a financial advisor for personalized guidance tailored to your specific circumstances.