CIT Bank Savings Connect Rate: Unlocking the potential of your savings starts with understanding the intricacies of interest rates. This isn’t just about numbers; it’s about maximizing your financial growth. We’ll explore the factors that influence these rates, delve into historical trends, and compare them to what other banks offer. Prepare to gain a clear picture of how your money can work harder for you.

We’ll navigate the process of opening an account, managing your funds, and utilizing the convenient online and mobile platforms. Discover the account’s features and benefits, including interest compounding, and weigh them against potential drawbacks. We’ll even examine customer experiences and the regulatory framework ensuring your financial security.

CIT Bank Savings Connect: A Comprehensive Overview: Cit Bank Savings Connect Rate

Source: thesmartinvestor.com

CIT Bank Savings Connect offers a competitive interest rate on savings accounts, appealing to those seeking higher returns than traditional savings accounts. This article provides a detailed analysis of its rates, features, benefits, and customer experiences, enabling you to make an informed decision about whether it aligns with your financial goals.

Understanding CIT Bank Savings Connect Rates

CIT Bank Savings Connect rates are influenced by several factors, including prevailing market interest rates, the Federal Reserve’s monetary policy, and the bank’s own financial position. Historically, CIT Bank Savings Connect rates have fluctuated in line with broader market trends, generally offering rates above the national average for savings accounts. A direct comparison with competitor offerings reveals that CIT Bank Savings Connect often holds a competitive edge, particularly for larger balances.

The interest calculation for CIT Bank Savings Connect typically employs a daily interest method, where interest is calculated daily on the account balance and credited monthly.

Accessing and Utilizing CIT Bank Savings Connect, Cit bank savings connect rate

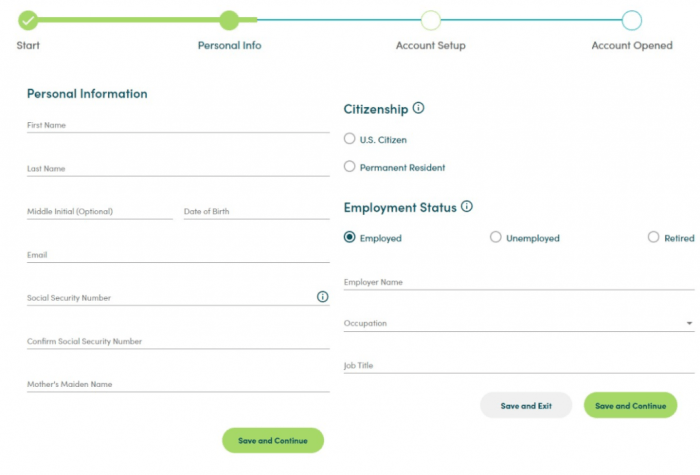

Opening a CIT Bank Savings Connect account is a straightforward process, typically involving an online application. Accessing account information and transaction history is readily available through the online banking platform or mobile app. Funds can be deposited and withdrawn through various methods, including electronic transfers, wire transfers, and potentially even physical mail (though less common for this type of account).

The mobile app and online platform provide a user-friendly interface for managing your account.

Checking the Cit Bank Savings Connect rate is a good first step, but if you’re looking to grow your business, you might need more than a savings account. Consider opening a business account with better features; check out open truist business bank account options to see what’s available. Then, you can compare that to your Cit Bank rate and make a smart financial decision.

| Feature | Description | Accessibility | Security |

|---|---|---|---|

| Account Summary | View current balance, available funds, and recent transactions. | Online and Mobile | Secure login and encryption |

| Transaction History | Detailed record of all deposits, withdrawals, and interest earned. | Online and Mobile | Protected by multi-factor authentication |

| Funds Transfer | Transfer money between CIT Bank accounts or to external accounts. | Online and Mobile | Secure transaction process with verification |

| Customer Support | Access to help resources and contact customer service. | Online and Mobile | Secure communication channels |

CIT Bank Savings Connect Account Features and Benefits

CIT Bank Savings Connect offers several key benefits, including competitive interest rates and convenient online and mobile access. The account features daily interest compounding, maximizing your returns. Compared to traditional brick-and-mortar banks, CIT Bank Savings Connect often provides higher yields.

| Feature | CIT Bank Savings Connect | Competitor A | Competitor B |

|---|---|---|---|

| Annual Percentage Yield (APY) | [Insert current APY – replace with actual data] | [Insert Competitor A APY – replace with actual data] | [Insert Competitor B APY – replace with actual data] |

| Minimum Balance Requirement | [Insert minimum balance requirement – replace with actual data] | [Insert Competitor A minimum balance requirement – replace with actual data] | [Insert Competitor B minimum balance requirement – replace with actual data] |

| Account Fees | [Insert fee structure – replace with actual data] | [Insert Competitor A fee structure – replace with actual data] | [Insert Competitor B fee structure – replace with actual data] |

| Online/Mobile Access | Yes | Yes | Yes |

While CIT Bank Savings Connect offers numerous advantages, potential drawbacks could include limited physical branch access (typical for online banks) and the need for a strong internet connection for online banking.

Customer Experiences with CIT Bank Savings Connect

Customer reviews often highlight the ease of use of the online platform and mobile app, along with the competitive interest rates. Customer service is generally accessible through phone, email, and online chat. Account opening and maintenance fees are typically minimal or non-existent, depending on the specific account type and terms.

- “The app is easy to navigate, and I appreciate the high interest rate.”

-John D. - “Customer service was responsive and helpful when I had a question about my account.”

-Jane S. - “I’ve been consistently impressed with the return on my savings compared to other banks.”

-Robert P.

A typical customer journey might involve online account application, followed by online or mobile banking for managing transactions and reviewing account statements. The process is generally streamlined and efficient, emphasizing digital convenience.

Regulatory and Legal Aspects of CIT Bank Savings Connect

CIT Bank Savings Connect operates under the regulations and laws governing financial institutions in the United States. Robust security measures, including encryption and multi-factor authentication, protect customer funds. Dispute resolution processes are in place, typically involving internal review and potentially arbitration if necessary. CIT Bank Savings Connect adheres to relevant consumer protection laws, ensuring fair and transparent banking practices.

Final Summary

Source: thesmartinvestor.com

Understanding CIT Bank Savings Connect rates is key to making informed financial decisions. By examining the factors influencing these rates, comparing them to competitors, and understanding the account features, you’re empowered to choose the best savings strategy for your needs. Remember, your financial future is built on knowledge and proactive planning. Take the steps to learn more, and watch your savings grow.